KEY TAKEAWAYS

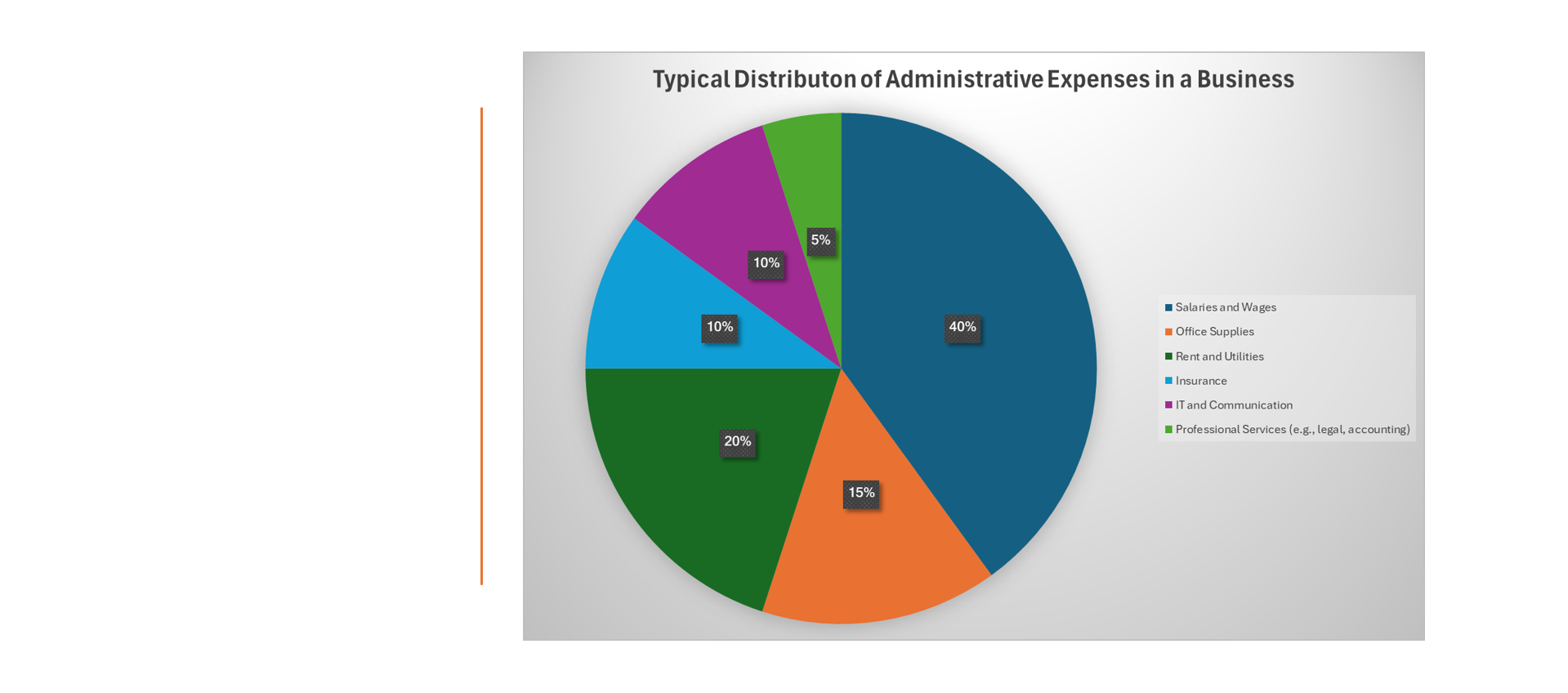

- Administrative expenses encompass a variety of non-production costs such as executive compensation, IT and accounting staff salaries, leases, insurance, office supplies, and services like legal and accounting. While these costs are not directly tied to production or services, they are crucial for basic operations and compliance with regulations.

- Different categorizations of administrative expenses exist within a company, including fixed and semi-variable costs. Fixed expenses are foundational and don’t fluctuate with production or sales levels, while semi-variable costs may change with business activity. Businesses focus on maintaining low administrative expenses to increase leverage and efficiency, often scrutinizing these costs for potential budget cuts.

- For fiscal management and tax purposes, admin expenses are used to measure financial health and can be deducted on tax returns if they are reasonable, ordinary, and necessary. Companies analyze the sales-to-administrative expense ratio to understand how much revenue is consumed by these expenses, enabling strategic decision-making regarding resource allocation and operational adjustments.

Identifying Key Areas of Focus for Cost Reduction

Identifying key areas where costs can be curtailed without sacrificing quality or operational efficiency is like playing financial detective in your own company. Start by scouring through every invoice and subscription receipt with a magnifying glass. You might uncover charges for services long forgotten or rarely used – these are low-hanging fruits ripe for cutting. Also, shining a spotlight on routine expenses can reveal patterns or services that may no longer be necessary. By pinpointing these areas, you create an opportunity for meaningful savings. Remember, in business, every penny saved is a penny earned towards your bottom line.

Differentiating Between Types of Expenses

Recognizing Fixed, Variable, and Semi-Variable Administrative Costs

Recognizing the nature of administrative costs is a bit like sorting your laundry – you need to know what goes where to manage them effectively. Fixed costs are those steadfast expenses that remain constant, such as rent, depreciation or base salaries. They’re the familiar items on your financial statements that don’t flinch, regardless of your sales antics. Variable costs, on the other hand, swing like a pendulum with the rhythm of your business activities – think commissions or shipping expenses that ebb and flow with sales. Semi-variable costs are the tricksters; they have a fixed component but also a variable element, such as utility bills with a base charge, website cost and usage fees. A sharp eye on these categories helps one prepare for the financial ebb and flow of business life.

Regular vs. One-off Expenses: Navigating the Dynamics

Navigating the dynamics between regular and one-off expenses is akin to balancing a seesaw. Regular expenses are your reliable everyday companions, occurring like clockwork – think monthly internet bills or weekly payroll. They’re predictable, allowing you to plan with a certain degree of comfort. One-off expenses, in contrast, are the surprise guests at your financial party – they pop up without warning, such as emergency repairs or sudden legal fees. While you might have a smooth system for regular payments, one-offs require a flexible but rigorous tracking process. Quick thinking and a well-organized financial contingency plan help ensure that these unexpected costs don’t tip your budget out of balance.

Cutting Down on Classic G&A Expenses

Smart Payment Methods to Streamline Expenses

In the quest to streamline expenses, smart payment methods are like wielding a magic wand over your company’s financial operations. Out with the tediously monitored company credit cards and chaotic cash transactions — it’s time to embrace prepaid cards geared explicitly for businesses. With these cards, every penny spent is effortlessly trackable, wiping out the need for cumbersome expense reports. The modern twist? They’re often coupled with digital platforms, automating the categorization and assignment of each transaction to the right budget. This tech-savvy approach brings your spending into sharp focus, offering real-time insights without the headache of manual data entry. Say goodbye to expense claims, and hello to financial clarity and control.

Going Green with Office Supplies and Utilities

Going green with your office supplies and utilities doesn’t just add an eco-friendly badge to your brand – it’s also a cost-effective move. Embracing digital over paper piles not only saves trees but also cuts down on storage needs and shaves dollars off your office supply budget. When it comes to utilities, LED lighting and energy-star rated appliances can reduce your electricity bill significantly. Plus, encouraging telecommuting can lead to a downsized office space and utility savings. A sustainability champion within your team could spearhead initiatives like these, fostering a culture of conservation while nudging the needle towards greener and cheaper administrative operations.

Strategies for Reducing Personnel-Related Expenditures

Reducing personnel-related expenditures is a delicate balancing act. On one side, you want to ensure your team remains motivated and satisfied; on the other, it’s crucial to keep overheads in check. It begins with smart hiring – bringing in multi-talented folks who can wear different hats means you get more bang for your personnel buck. Investing in training can elevate your team’s efficiency so that work gets done faster and better. And let’s not overlook the potential of technology; from automated HR systems to collaborative cloud-driven tools, they can reduce the man-hours needed for repetitive tasks. Remember, the goal isn’t to trim your team to the bone, but to optimize every team member’s contributions toward the company’s financial health.

Overhead Costs: Minimizing without Compromising

Minimizing overhead costs without compromising quality strikes a chord with businesses striving for efficiency. It often starts with questioning the status quo – do you really need that sprawling office, could a smaller space or co-working option work? Renegotiating with suppliers can also shave off a good chunk from your recurring expenses without affecting the quality of goods and services received. Adopting technology, such as cloud-based tools, stream thoughts and processes, may initially seem like an added cost, but often pays for itself with the boost in productivity. It’s a strategic dance between cost-cutting and value-keeping, ensuring your business’s engine maintains its hum while using less fuel.

Modern CFOs and Financial Stewardship

Modern CFOs are redefining financial stewardship, no longer just gatekeepers of the budget but strategic visionaries who propel the company forward. They navigate the complex currents of global finance with an eye on sustainability and innovation. A modern CFO doesn’t simply crunch numbers but interprets them into stories that outline past performances and predict future trends. They value transparency, championing open books that foster trust among stakeholders and provide clear insights for decision-makers. And in a world where data reigns supreme, they harness sophisticated analytics to drive strategic investments and pinpoint cost-saving opportunities, all while ensuring regulatory compliance and risk mitigation.

Leveraging Technology for Administrative Efficiency

Leveraging technology for administrative efficiency is akin to equipping your office with a set of superpowers. Gone are the days of heaping paperwork and snail-paced processes. Welcome to an era where cloud accounting software, AI-driven data analysis, and automation tools are the new normal. These technologies streamline tasks that used to consume hours into mere clicking of buttons, giving teams the luxury to focus on strategic decisions over mundane data entry. Automation of invoicing, payroll, and expense management not just improves control but slashes down the likelihood of human error. By turning to tech solutions, businesses can experience a significant transformation in speed, accuracy, and, ultimately, in their ability to do more with less.

Implementing Effective Change Management

Implementing effective change management is essential for businesses looking to stay nimble and responsive in a fast-paced economic landscape. It’s about leading the organization through a metamorphosis, ensuring that operational, technological, and personnel shifts are embraced rather than resisted. A well-crafted change management plan involves clear communication that demystifies the ‘why’ behind changes, robust training that empowers employees to thrive in a new environment, and ongoing support to navigate any turbulence. The key is to align everyone’s efforts towards a common vision, creating a sense of unity and purpose. With a carefully coordinated change management strategy, companies can pivot smoothly and with minimal disruption, seizing opportunities for growth and improvement.

Legal and Consulting Fees: Maximizing Value for Money

Maximizing value for money when it comes to legal and consulting fees is all about smart allocation of resources. Regular legal fees, such as retaining a lawyer for compliance checks, can be a strategic investment, safeguarding the business from risks and fines. However, you don’t always need the most expensive law firms; instead, opt for professionals whose expertise and fee structure align with your needs. Make sure to clarify the scope of work and negotiate flat fees for projects to avoid surprises. When it comes to consultants, ensure their involvement translates into tangible benefits, such as enhanced processes or increased revenue. Regular reviews of the outcomes achieved versus costs incurred can also guide future decisions, ensuring every dollar spent on legal and consulting services is an investment, not just an expense.

Innovations in Financing and Investments

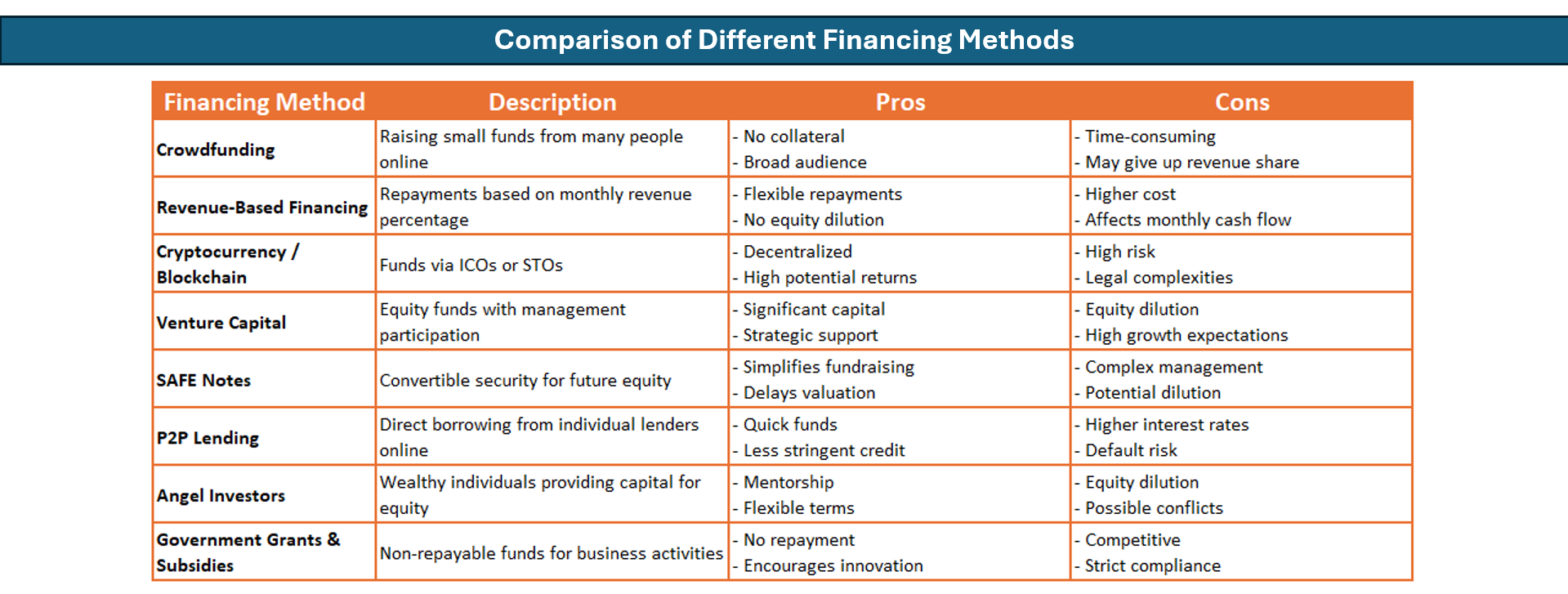

Innovations in financing and investments have transformed the landscape, offering businesses a plethora of options beyond traditional bank loans. Crowdfunding platforms invite a diverse array of investors to contribute to your vision, often without the need for collateral. Revenue-based financing aligns repayments with your incoming cash, easing the pressure during slower business periods. The emergence of cryptocurrency and blockchain technology has introduced new, decentralized avenues for raising funds, although they come with their own set of risks and regulations. And let’s not overlook the role of venture capital and SAFE notes, providing startups with the necessary runway to take off in exchange for equity stakes. Familiarity with these innovative tools not only broadens your horizons but also equips you with a competitive edge in securing the financial fuel for growth.

FAQ: Mastering Administrative Expense Management

What Are Some Common Mistories About Cutting Administrative Costs?

One common myth is that slashing administrative costs always leads to efficiency. However, excessive cuts can harm employee morale and reduce service quality. Another misconception is that only non-essential services can be trimmed; strategic reductions in essential areas can also be effective when done carefully. Finally, there’s a belief that cost reduction is a one-off event, rather than an ongoing process requiring continuous review and adjustment.

How Can Companies Effectively Reduce Utility and Office-Related Expenses?

Companies can effectively reduce utility and office-related expenses by implementing energy-efficient practices, such as switching to LED lighting and investing in smart thermostats. Remote work policies can also cut down on the need for large physical office spaces, thereby saving on rent. Additionally, by opting for digital communications and cloud storage solutions, businesses can reduce the need for office supplies and better manage their physical space.

What is the sg&a sales ratio (or percent of sales method)?

The SG&A sales ratio, or percent of sales method, is a financial metric that shows the proportion of Selling, General, and Administrative expenses in comparison to total sales revenue. It’s calculated by dividing total SG&A expenses by total sales revenue and multiplying by 100. This ratio helps assess how efficiently a company is managing its overhead costs relative to its sales performance.

How do you know if you’re spending “too much” or “just about enough” on admin costs?

To gauge if you’re spending too much or just enough on admin costs, you’ll want to benchmark against the industry standards and historical company data. Using the efficiency ratio, compare your G&A expenses to revenue over time. If the percentage is rising without corresponding growth in productivity or sales, you might be overspending. Regularly monitoring this ratio can help maintain a healthy balance between cost control and investment in necessary administrative functions.